Once the cash is gone from the envelope, the spending ceases until it’s time to refill the envelopes.ġ4.

Start using the Envelope System for expenses that make the biggest dent in your budget such as groceries and entertainment. Although we had been with the same Auto Insurance company for many years, we recently found a more affordable option with a different company for the exact same coverage.ġ3. See our Meal Planning Pinterest Board for Ideas.ġ2. Stop making impulse purchases at the grocery store and start meal planning! It not only saves time but can save money also when meal planning around the grocery store sales. Invest $20 on an Indoor Foldable Drying Rack. We don’t want everything dried on the line but at least a few loads per month will reduce the energy bill. The dryer is a major source to your energy bill. Alcoholic beverages are a major blow to the grocery budget. Power Strips are the answer so that you just mash the button once.ĩ. I even unplug my Can Opener when not in use. When you add together all of the many things always plugged in, it adds up. Keeping things plugged in all of the time is convenient but those outlets are pulling electricity.

#PRINTABLE HOUSEHOLD BUDGET HOW TO#

Also See: How To Use Milk Jugs For Winter Seed Sewing At the least, you can grow herbs for cooking. Learn to garden and grow your own vegetables. Take a break and see the difference in your spending habits.ħ. Yes they are only X dollars and of course we can justify buying in bulk but are you over-spending when you go? Don’t renew your membership. Do not renew magazine subscriptions and don’t buy any new one’s either!Ħ. Why pay for both? If you can save $12 per month, that is $144 per year you can apply towards debt.ĥ.

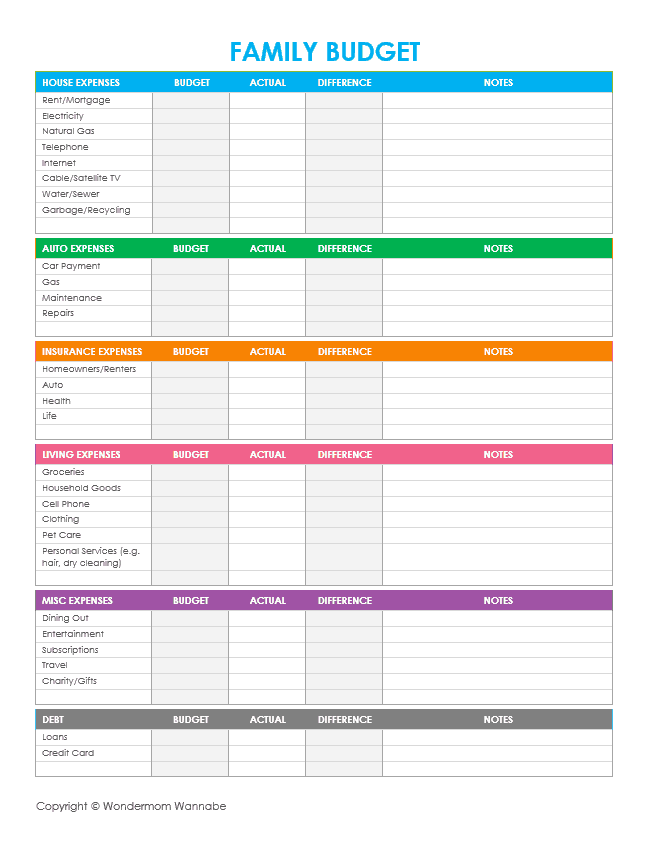

Turn off your land line phone, if you also have a cell phone. How long have you been paying for it and never used it? Have you read the fine print? It might not pay anyway unless the circumstances are exactly right.Ĥ. Are you paying for channels you never watch?ģ. They are a non profit organization whose purpose is to assist you with regaining control of your finances.ġ5 Possible Ways To Decrease Family Expenses:ġ. If your expenses exceed your income, there is help.Ĭheck with Consumer Credit Counseling for assistance with things like reducing credit card interest fees and debt consolidation.

Let your mantra be “If it is to be, it is up to me” It’s easy to get either really excited about the possibilities or depressed upon the realizations.

0 kommentar(er)

0 kommentar(er)